michigan gas tax increase 2021

WILX - Michigan gas prices are now at a new 2021 high after an increase of nine cents from last week and could remain high for awhile. The current state gas tax is 263 cents per gallon.

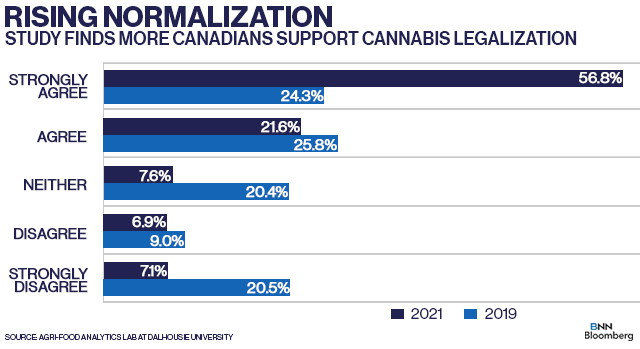

Cannabis Canada Weekly Legalization Spurs More Canadian Consumption Study Says Bnn Bloomberg

When the gas tax increase kicks in just months from now Michigan residents will find themselves paying as much as 14 cents more per gallon.

. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. So for one gallon of gasoline at 417 per gallon Tuesdays average in Michigan youre paying 067 is taxes alone. 19 2021 at 928 AM PDT.

Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as. WJRT -- Gas prices increased by 20 cents in a matter of hours around Mid-Michigan. Drivers started Thursday morning with gas at 479 a gallon for regular.

Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on unincorporated businesses. Some state and local officials are now using potential revenue losses from the COVID-19 crisis as a reason to raise taxes. If the Michigan Republicans get their way it.

But as of Thursday. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. A House Fiscal Agency analysis released Thursday said the.

Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as California Hawaii Illinois and Nevada according to the. Under the governors proposal a 45-cent increase would occur in three. Raise the rate for people with an annual taxable income over 175000 350000 for joint filers.

Increase individual income tax collections by 15 billion a year not giving the legislature the option to decrease collections again until 2025. The funds from this increase would be dedicated to education and infrastructure. 1 2020 and Sept.

A 45-cent tax increase per gallon of gas. Mackinac Center Policy Forum Virtual Event At the beginning of the last legislative term Gov. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

The increase is capped at 5 even if actual inflation is higher. For fuel purchased January 1 2017 and through December 31 2021. Alternative Fuel which includes LPG 263 per gallon.

Referred to the House Tax Policy Committee on November 30 2021. For fuel purchased January 1 2017 and through December 31 2021. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St.

Introduced by Rep. As such a 45-cent increase would bring Michigans total average gas tax to 8913 cpg by far the highest in the nation and over 30 cents higher than in Pennsylvania which currently has the highest gas tax 587 cpg. Whitmer is bonding for over 35 billion to finance fixing trunkline roads which have been destroyed by.

Whitmer failed in her push for a 45-cent-per-gallon gas tax increase which the governor claimed would raise an estimated 25 billion. So far in 2021 inflation has been unusually high. Official Text and Analysis.

If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. It will have a 53 increase due to a. Gretchen Whitmer proposed a large tax hike.

Mar 25 2020. In Michigan Jet Fuel is subject to a state excise tax of 003 Point of Taxation. Steven Johnson R on November 30 2021 To repeal an annual state gas and diesel tax increase based on the inflation rate for the past year which was imposed with a general increase in these taxes in 2015.

MPSC approves 84M rate increase for DTE Gas Co 57 lower than company sought Skip to main content MPSC Michigan Public Service Commission About the MPSC Commission Activities Commission Activities collapsed link Consumer Information. Currently Michigans fuel excise tax is 263 cents per gallon cpg. The FAQs on this page are effective January 1 2022.

Whitmer said her proposal would raise 25 billion for roads though budget documents pegged the net new revenue at 21 billion in 2021. 2480 cents per gallon -327 less than national average 2021 diesel tax. 1 the increase went into effect raising the gas tax from 19 cents per gallon to 263 cents while diesel went from 15 cents to 263 cents.

DEARBORN Mich July 6 2021 - Gas prices in Michigan declined slightly after setting a new 2021-high of 321 per gallon last week. The Michigan state average is 9 cents more than a week ago. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

Michigan drivers are now paying an average of 320 per gallon for regular unleaded which is 9 cents more than a week agoThis price is 18 cents more than this time. The current state gas tax is 263 cents per gallon. Michigan gas tax increase 2021 Monday March 14 2022 Edit.

On January 1 2022 Michigan drivers started paying a tax of a little more than 27 cents per gallon for the state motor tax aka gas tax. Diesel Fuel 263 per gallon. Michigan gas tax increase 2021 Monday March 14 2022 Edit.

And the states gas tax as a share of the total. Gasoline 263 per gallon. Rack Payment of Michigan Fuel Excise Taxes Payments of fuel excise taxes are made by fuel vendors not by end consumers though the taxes will be passed on in the fuels retail price.

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Don T Be Fooled By Gas Tax Kabuki Mackinac Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

State Corporate Income Tax Rates And Brackets Tax Foundation

Cannabis Canada Weekly Legalization Spurs More Canadian Consumption Study Says Bnn Bloomberg

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Gop Outraged As Gov Gretchen Whitmer Rejects Gas Tax Holiday Michigan Income Tax Cut Bridge Michigan

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

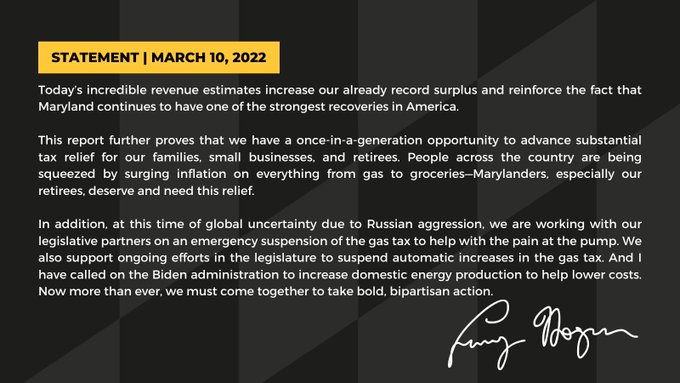

Fuel Tax Relief Efforts Ramp Up At Statehouses Land Line State

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

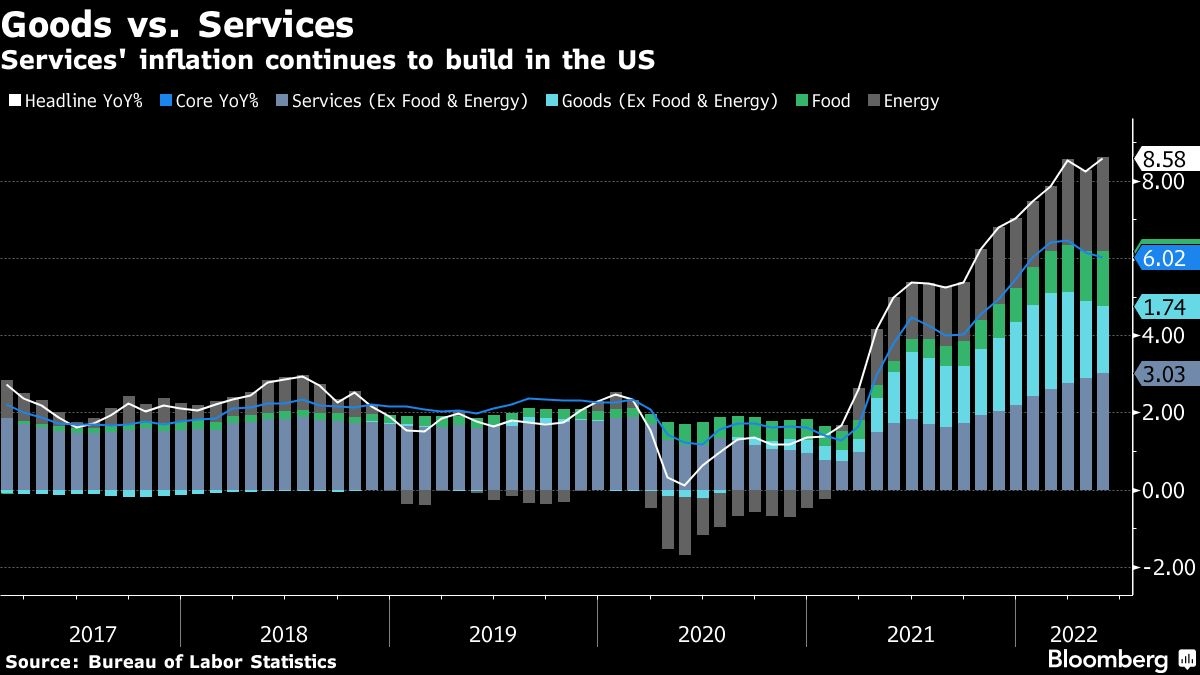

U S Inflation Quickens To 40 Year High Pressuring Fed And Biden Bnn Bloomberg

Don T Be Fooled By Gas Tax Kabuki Mackinac Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan